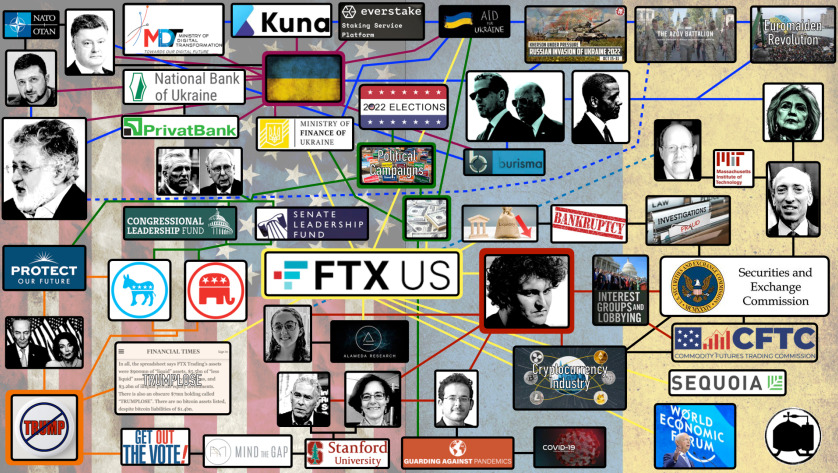

Sam Bankman-Fried has been charged with running one of the largest financial crimes in history accounting for a massive money laundering operation prosecutable as enterprise fraud under the RICO statute. The crimes SBF is alleged to have committed tabulate a staggering value of approximately $10 billion. The theft of $10 billion of other peoples’ money is what I call “unavoidable circumstances,” and that’s where SFB’s problems begin. Where those problems will end is a forgone conclusion, and this article is further evidence of that. The FTX fix is in.

For perspective, SBF/FTX easily falls into the top nine historical cases of corporate fraud:

- Theranos

- Wirecard

- Luckin Coffee

- Wells Fargo

- Volkswagen

- Enron

- WorldCom

- ZZZZ Best

The distinctly egregious and politically enmeshed criminality of Sam Bankman-Fried even caused me to brand him ‘today’s John Corzine.’ I wrote an entire article on it: Today’s Sam Bankman-Fried Is Yesterday’s John Corzine and In Between Is the Same Obama-Biden-Clinton Cartel.

John Corzine was the mastermind and driver of the investment strategy that led to the bankruptcy of MF Global in 2011. Under Corzine’s leadership and strategy, MF Global speculated on the purchase of billions of dollars of risky European bonds. Corzine believed them to be a great investment.

Let us not forget Joe Biden’s own words back in October 2009 when he spoke of the Obama administration’s quandary regarding how to deal with the 2008 banking turmoil: “I literally picked up the phone and called Jon Corzine and said, “Jon, what do you think we should do?” The reason why we called Jon is because we knew he knew about the economy, about world markets, about how we had to respond, unlike almost anyone we knew.”

Two of Jon Corzine’s biggest supporters were Barack Obama and Vice President Joe Biden.

Forward to the present, who is the primary beneficiary of the Sam Bankman-Fried/FTX money laundering operation based out of Ukraine?

Joe Biden is the primary beneficiary, and Sam Bankman-Fried is today’s, John Corzine.

Biden and Ukraine have a long history that includes Biden’s inroads there in 2012 when he and Hunter began their private equity entanglements with Burisma relative to leveraging the energy sector as a primary conduit to move money globally.

Then back in 2014, the Obama/Biden/Clinton/Kerry/Nuland cartel collaborated with the intelligence community to engage in regime change in Ukraine vis-a-vis the Euromaidan Revolution. That coup d’etat eventually led to the installation of an actor into the Ukrainian presidency – Volodymyr Zelensky – as the U.S./Globalist proxy.

In short, Zelensky was installed as the point man to manage the operation, and all of it was made possible by Ukrainian oligarch Ihor Kolomoyskyi. For a comprehensive understanding, read this article from the series: The Keystone of Corruption: Ukraine, the FTX Scandal, PrivatBank, the National Bank of Ukraine and Ihor Kolomoyskyi.

Long ago and to some degree of criticism, I branded Ukraine the ‘keystone of corruption’ based on several years of arduously investigating the nation as the central node of political corruption and fraudulent activity. Throughout this series, the analysis and evidence have rested on this work.

As the analysis of the SBF/FTX/Ukraine scandal began, I immediately assumed a critical position that was bolstered by developments out of SDNY: A corrupt SDNY interceded on SBF’s scheduled remote House testimony as a measure to prevent public disclosure of the details that directly tie back to the U.S. politburo by arranging for his Bahamian arrest and incarceration pending extradition to the U.S. Therein, the identified pretext clearly indicates that SBF’s massive degrees of criminality will be deescalated to lesser charges in exchange for his implicit agreement not to roll over on his handlers and principals like Caroline Ellison rolled over on him, which was also accurately projected.

New developments in the SBF/FTX/Ukraine scandal build on that position.

Not surprisingly, the political entanglements of SBF/FTX are both the problem and the solution. By that, I mean that the political class as beneficiaries of stolen and laundered money represents a massive amount of political corruption and criminality that is deserving of full sunlight and fidelity to prosecution, to the extent that a large swath of politicians should be removed from office.

This dynamic is precisely why the FTX fix is in. Simply stated, the establishment can’t afford this account of history to make the record. Therefore, the unavoidable circumstances must be proactively steered to the most desirable landing spot, and that entails SBF taking the fall. Ergo, the problem becomes the solution because one-in-three members of Congress directly received laundered funds that were in part sent to Ukraine by their own congressional activity.

To examine the complete list of 196 members of the 118th Congress who were direct recipients of FTX funds exceeding $46 million over several election cycles, see this publication from CoinDesk [h/t Marco Polo.]

As I previously reported, counsel at FTX is engaging in clawbacks to recover political donations, and congressmen are exercising different options, from returning the funds to donating them to charities to retaining them and doing nothing at all.

In my analysis, I characterized the clawbacks as a politically strategic maneuver: “This constructed FTX clawback will permit the corrupt U.S. politburo, which includes Senate Minority Leader Mitch McConnell and newly elected House Speaker Kevin McCarthy, to claim innocence and plausible deniability by saying, “We didn’t know that FTX’s donations were dirty money, so we did the right thing and gave it back.” For anyone believing that, I have ocean-front property in Kentucky that I’d like to sell you.“

The clawback dynamic has intensified. Counsel for FTX has now issued private letters to politicians and PACs in direct receipt of FTX donations while establishing a February 28th deadline to voluntarily return the money or face legal action.

With $5.5 billion in liquid assets already recovered, FTX’s attorneys are in overdrive, attempting to “unring” the bell in their recovery efforts.

Reporting indicates that counsel for FTX is also working to recover $400 million sitting in a JPMorgan account that Sam Bankman-Fried previously used to invest in an obscure hedge fund Modulo Capital, which traded crypto and traditional financial assets.

Not to be confused with the similar Modulo Capital based out of Brazil, this Modulo Capital operated out of the same luxury Bahamian condominium community where Sam Bankman-Fried and other FTX employees lived. Modulo was started by two former Jane Street traders: Duncan Rheingans-Yoo and Xiaoyun “Lily” Zhang.

The backdrop to Modulo is a bit “mysterious,” and not much information is available, while the hedge fund has not responded to requests for comment from CoinDesk. A public filing indicates that Modulo was based in the Bahamas and operated from Albany, the luxury condominium complex previously housing Bankman-Fried and other FTX and Alameda employees.

SBF and his ex, Caroline Ellison, both previously worked at Jane Street, which is a New York-based proprietary trading firm. Bankman-Fried has a reputation for hiring former Jane Street personnel as executives or employees, and this included former FTX US President Brett Harrison.

Founded by a small group of traders and technologists in a tiny New York office, Jane Street has more than 2,000 employees across five global offices and trades in a broad range of asset classes on more than 200 venues in 45 countries.

Recalling an underlying position in all of my analysis that implicates Harvard University as a hub of Chinese-based corruption, Jane Street founder Duncan Rheingans-Yoo, who is a native of Columbia, MD, graduated from Harvard.

The FTX entanglements become even more complicated knowing that FTX also hired Rheingans-Yoo’s older brother, Ross Rheingans-Yoo [Jane Street] for a top job at the FTX Foundation, which is a charitable group funded by Mr. Bankman-Fried.

Rheingan-Yoo’s business partner is Xiaoyun “Lily” Zhang, who was romantically involved with SBF previously, attended Amherst College.

Further drawing in the problematic infiltration of the U.S. by China and according to a publication in The Amherst Student interviewing “Lily Zhang ’12” [Xiaoyun “Lily” Zhang], she responded to a question about her origins with “Communist China. Represent, yo.” No matter what strings I pull, they always thread back to China. Zhang also spent a year studying at Oxford.

The circumstances of Sam Bankman-Fried’s conditional release were also problematic respective to his restrictions on internet and application usage and his counsel’s desire to keep secret the identities of SBF’s bond sureties. Those identities have now been revealed in a recently unsealed court document as being two Stanford University employees: Larry Kramer, the former dean emeritus of Stanford Law School, and Andreas Paepcke, a Stanford senior research scientist and computer science expert.

Since 2012, Kramer has been president of the William and Flora Hewlett Foundation, which has assets of over $9 billion and was the sixth-wealthiest and the eighteenth-most generous foundation has granted more than $3.5 billion in 2014. Its program area interests include Education, Environment, Global Development and Population, Performing Arts, Madison Initiative, Cyber, Effective Philanthropy, San Francisco Bay Area, and Special Projects.

The conditions of SBF’s release were complicated by SBF’s recent use of a virtual private network [VPN], which provided him secret access to the internet. More serious allegations of SBF violating the terms of his release were found in his use of the internet, devices, and messaging applications to engage in witness tampering in his case. It has caused the judge overseeing SBF’s case to consider to revoking SBF’s bail and remanding him back to custody.

I believe that Bankman-Fried’s haphazard and reckless approach to abiding by the terms of his conditional release, where he appears to wittingly violate those terms with near impunity, is evidence of his knowledge that the fix is in and that he’ll likely be facing a reduced prison sentence for his agreement to take the fall for the U.S. politburo and others.

More evidence of this is found in Bankman-Fried’s loose lips, where he continues to engage in discourse that should sink his ship if he weren’t in a privileged class of criminals facing a predetermined outcome. Recently, SBF’s counsel expressed concern over the risk of his propensity to defend himself in the court of public opinion before he gets to trial.

As Rebecca Mermelstein, a defense attorney at the law firm O’Melveny, put it, “I think every white-collar lawyer you could ask would say, shut up, right? Keep your mouth shut, and let us do the talking.”

In the Mermelstein interview, which included Bankman-Fried, he remarkably stated, “All my Republican donations were dark, and the reason was not for regulatory reasons. It’s ’cause reporters freak the [expletive] if you donate to Republicans.”

*Images of Federal Prison Camp in Alderson, WV where Martha Stewart served her sentence

Since the very beginning, I’ve maintained that we are bearing witness to the controlled demolition of FTX and Sam Bankman-Fried due to unavoidable circumstances arriving at a price tag of $10 billion or more. The crimes are clear. The parties to those crimes are clear. The fix is in, and that is clear, too. Loose lips sink ships unless you’re Sam Bankman-Fried and in his case, he’ll be facing reduced time in a facility suitable for Martha Stewart.

The FTX fix is in. Write it down. Dead horse kicked. Again.

-End-

This piece was written by Political Moonshine on February 19, 2023. It originally appeared in RedVoiceMedia.com and is used by permission.

The opinions expressed by contributors and/or content partners are their own and do not necessarily reflect the views of LifeZette.

Join the Discussion

COMMENTS POLICY: We have no tolerance for messages of violence, racism, vulgarity, obscenity or other such discourteous behavior. Thank you for contributing to a respectful and useful online dialogue.