Merry Christmas to you all! ‘Tis the season for giving, not taking, and certainly not stealing. Someone should have told that to Sam Bankman-Fried, who, by all appearances, is today’s John Corzine. In between Sam Bankman-Fried and John Corzine is a cartel of the usual suspects with Barack Obama, Joe Biden, and Hillary Clinton at the core.

Once the direct correlations and nexuses I establish and evidence in this piece are examined, it becomes clear that the Sam Bankman-Fried/FTX/Ukraine money laundering operation with deep Democratic ties and obscene donation amounts to those Democrats [and Republicans] equates to rinse-repeat mode. SBF/FTX is no anomaly, rather, it’s a brazen reconfiguration of Corzine’s operation that was evolved to cryptocurrency and far greater criminality.

Respective to Democrats and Republicans, just to be clear, and as I always say, there’s no difference between the two except that Democrats stab you in the front while Republicans stab you in the back.

This is the 17th article in this series branded The Keystone of Corruption, which is a reference to Ukraine because the scope of the corruption, crime, and treason in Ukraine far exceeds SBF/FTX.

Let’s begin with giving appropriate credit where credit is due. I was tipped off to the entire premise for this article by the smartest and wisest person I know. He’s made cameos in Moonshine work for a long time, and I simply refer to him as Wall St. Thank you, Wall St. Let’s get to brass tacks.

Before we ask and answer, “Who is John Corzine?” it’s incumbent upon us to review my projection for Sam Bankman-Fried because new developments respective to SBF’s $250 million bail and his conditional release to his parents – as if he got wrangled up for underage drinking instead of stealing billions from a million folks – bears down and deserves very close scrutiny.

I reviewed the projection for SBF in the last article, and succinctly, the position holds that a corrupt SDNY interceded on SBF’s scheduled remote House testimony as a measure to prevent public disclosure of the details that directly tie back to the U.S. politburo by arranging for his Bahamian arrest and incarceration pending extradition to the U.S. Therein, the identified pretext clearly indicates that SBF’s massive degrees of criminality will be deescalated to lesser charges in exchange for his implicit agreement not to roll over on his handlers and principals like Caroline Ellison rolled over on him, which was also accurately projected.

This projection accurately extends to SBF’s bail and conditional release to house arrest under the supervision of his parents, as mentioned. Therein, the devil is in the details as folks may be thinking that $250 million is a steep price for SBF’s release, and that would assume that money actually exchanged hands.

It didn’t. I’ll say that again. No money exchanged hands for SBF’s bail and release.

Here are those details [emphasis added]:

In the typical federal case, a bail bondsman would charge between 10%-15% of the amount in cash to issue a surety bond or “bail bond.” In the case of Bankman-Fried’s astronomical bond, 15% of $250 million would be $37.5 million. But Bankman-Fried did not pay $37.5 million for his bond. No, Bankman-Fried actually paid no cash at all for his “$250 million bond.” Nothing. Zero.

There is a second way to acquire a bail bond. A defendant, or someone on their behalf, may pledge collateral in the full amount of the bond. Then, if the defendant fails to appear in court, the pledged collateral is forfeit to the court. So, in Bankman-Fried’s case, that would mean he would need a benefactor to step up and pledge property worth $250 million to get the bond. But that did not happen either.

Instead, Bankman-Fried’s parents promised to pledge as collateral their Palo Alto, California, home, where he’ll also be staying under house arrest. The Palo Alto home is rumored to be worth $4 million. And that is the full extent of the collateral pledged to guarantee the $250 million bond. No other collateral was posted or promised.

James A. Murphy, founder and chairman of law firm Murphy & McGonigle / CoinDesk

Consider this devilish detail from James A. Murphy: “Bankman-Fried walked out of court essentially a free man by signing a piece of paper where he promised to pay the court $250 million if he decides to flee to another country with no extradition. This, of course, is totally absurd.”

So then, if SBF made a successful break to a country with no extradition treaty, he gets to stay there Scot-free. Cue the circus music because this is a clown show.

This is also the two-tier justice that I so often cite in Moonshine work. Not surprisingly, as soon as the cooked-up bail was issued, which is entirely indicative of the FTX fix that I have projected, the Obama-appointed Judge Ronnie Abrams, who issued that bail, recused herself. This is banana republic stuff.

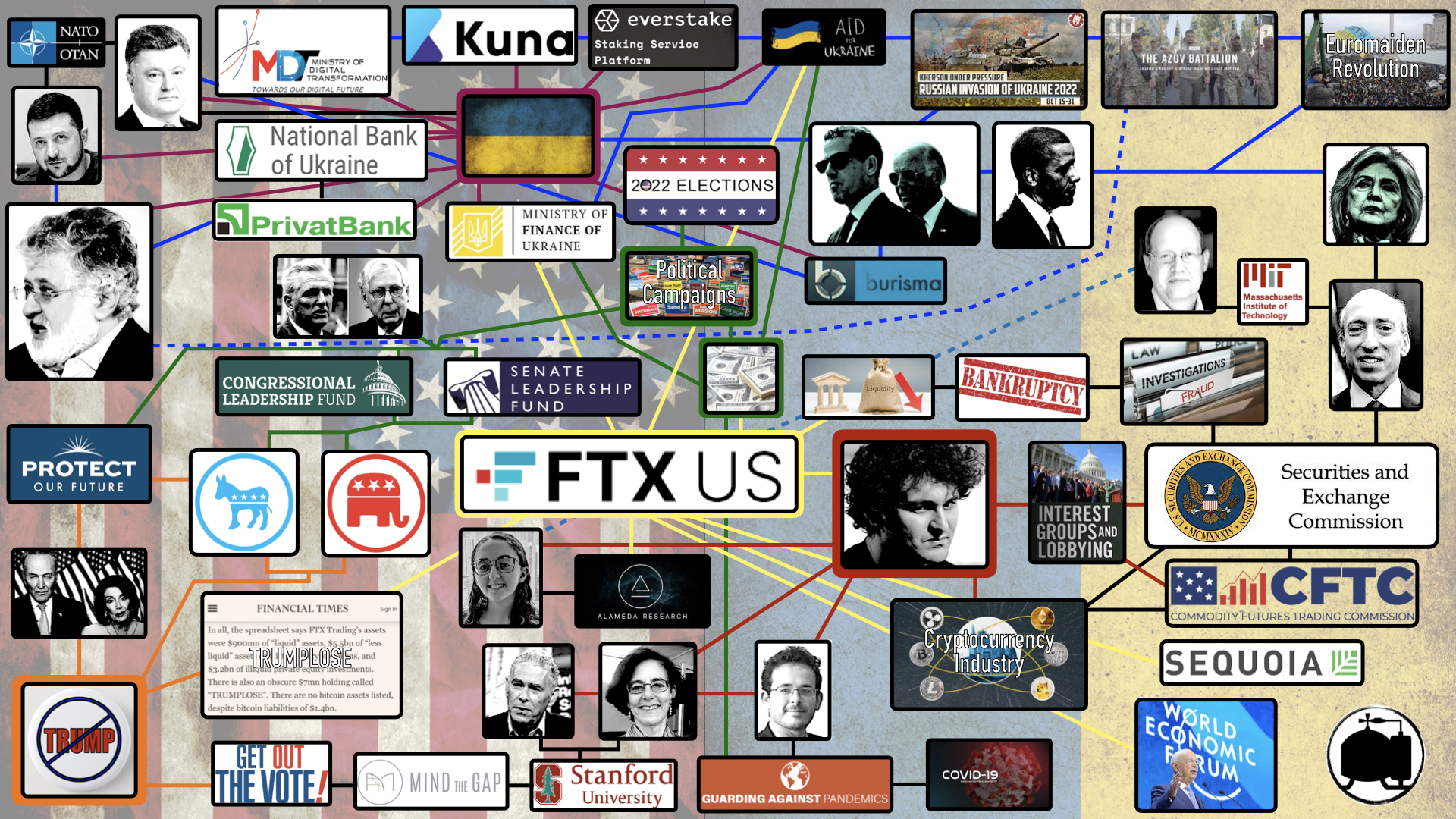

It’s important to recall who Bankman-Fried’s parents are, and I briefly covered the details of the longtime Democratic activists, stalwarts, and Stanford University professors in the first article, remembering that Stanford University received massive amounts of money from the primary culprit in the treason undoing this country: China. SBF’s parents and brother are featured bottom-center in the schematic below.

As Breitbart reported: “Stanford University is facing criticism over its extensive relationship with the Chinese government. Between 2013 and 2019, the university reported that it had accepted $58 million in gifts and contracts from China and its communist government. Only Harvard, USC, and the University of Pennsylvania have taken more money from China.” The important takeaway is found in the the amount of money and the time frame for it, which directly comports with the run-up to the enterprise fraud construct of the COVID-19 “pandemic.”

Moreover, and respective to the notion of “all in the family,” also recall that Gabe Bankman-Fried operates a second apparent money laundering operation respective to COVID-19. I covered it in detail in this previous article.

In the same article detailing money laundering, I also evidenced how the FBI reestablished money laundering as a top priority immediately preceding Donald Trump’s inauguration, meaning that the FBI positioned itself to serve as a protector of those operations in its longstanding and ongoing corruption.

So and respective to his parents and the aggregate of these details, SBF’s bail is as highly suspicious as is his highly suspicious arrest, which serves as the interceding maneuver on SBF’s House testimony. Like I’ve projected, the FTX fix is in, and SBF’s net $0 bail is another clear indicator of this.

SBF stole billions and is now doing hard time chilling in a posh crib in Palo Alto. Go figure. The FTX fix is in.

Who is John Corzine?

To answer this question, we draw all of the way back to 2011-2012, which is the same timeline for illegitimate President Joe Biden’s inroads to Burisma in Ukraine vis-a-vis his offspring, bagman Hunter Biden. Much can be learned about the Biden Crime Family’s rampant criminality in Ukraine and elsewhere by studying Marco Polo’s [founded by former Trump White House advisor Garrett Zielger] authoritative report on the Hunter Biden hard drive/laptop.

John Corzine is the [source],

Former NJ Governor [and] “mastermind” of a risky scheme that sank the financial firm he took over after he lost the governor’s mansion to Chris Christie.

[…]

“Mr. Corzine was the mastermind and the driver” of the investment strategy that led to MF Global’s 2011 bankruptcy, lawyer James Cusick told the jury [in his trial over the matter.]

[…]

“MF Global bought billions of dollars of risky European bonds because its Chief Executive Officer, Jon Corzine, thought they were a great investment,” Cusick said. “He will tell you himself that he directed MF Global to buy and keep buying European bonds because he thought those bonds were many many times more profitable” than any other investment trade, Cusick said.

NY Post

Corzine had been a trader at Goldman Sachs, and [source]

Became the company’s chairman and CEO in 1994. As a 2000 New York Times hagiography of Corzine noted, “While he helped build the bond trading department of Goldman Sachs into a wildly profitable arm of the company, he was admittedly careless as an administrator and was forced out of the firm because several senior partners were angered that he made major decisions without consulting them.”

American Spectator

Corzine patterned Goldman’s risky operations after the highly leveraged hedge fund Long Term Capital Management, which eventually collapsed. As Ross Kaminsky, the author of the American Spectator source, indicates:

Corzine aggressively courted Nobel laureate-founded LTCM as a client for Goldman, structuring a deal that allowed Goldman some knowledge of what LTCM was doing, and then copying LTCM’s strategies for Goldman’s own accounts. As LTCM was collapsing, Goldman posed as a potential white knight while trading in a frenzy for its own accounts; after all, since they had copied LTCM, that firm’s losses were turning into Goldman’s losses. Lowenstein quoted Corzine: “[Goldman] did things in markets that might have ended up hurting LTCM. We had to protect our own positions. That part I’m not apologetic for.”

American Spectator

Corzine’s refusal to accept the reality of his decisions and actions are akin to Bankman-Fried’s initial statements claiming that he’s not a criminal and did not intend to do what he did, which was deliberately engage in egregiously high levels of criminality on behalf of his handlers and principals.

Then the truth about Corzine and Goldman emerges [source]: “In the end, Corzine’s LTCM-related activities cost Goldman about half a billion dollars. In other words, he wasn’t forced out of Goldman because he didn’t “consult” with other partners. It was because he was, and obviously remains an out-of-control gambler—and I say that as a professional trader inclined to give other traders the benefit of the doubt.”

We see direct overlays in the criminality between Bankman-Fried and Corzine in Corzine’s actions at Goldman and those at MF Global, where investors’ segregated funds were moved and leveraged in speculative gambling maneuvers that caused the funds to vanish into thin air [source] [emphasis added]:

The bankruptcy was caused by Corzine’s decision (if I may borrow a phrase from Corzine’s good friend, President Barack Obama) to fundamentally transform MF Global from a sizeable but relatively staid commodities brokerage firm into a gambling enterprise. MF, which was spun off from the British firm Man Financial in 2007, not only risked the firm’s own money but then used customers’ funds to plug the holes when Corzine’s massive speculative purchases of European government debt went south. Fundamentally transforming something that was already working pretty well is perhaps not the best strategy for success.

American Spectator

In a repeating pattern indicative of Corzine’s propensity to make significantly risky decisions unilaterally, his own employees threw him under the bus at MF Global despite his denials: “A CME auditor also participated in a phone call with senior MF Global employees wherein one employee indicated that Mr. Corzine knew about loans that had been made from the customer segregated accounts.” Not surprisingly, Corzine denies all knowledge of these transfers.” [Source]

Corzine wasn’t restricted to the private sector, either. Consider his management of the State of New Jersey, where we see the continued repeating pattern:

The best description of Corzine’s mismanagement comes from his successor, Chris Christie, in a February 2011 speech at the American Enterprise Institute [source]:

When I came into office we confronted a $2.2 billion budget deficit for fiscal year ’10. The one that had five months left. The one that Governor Corzine told me was just fine, cruise path into the end of the fiscal year; Governor, don’t worry about it, everything is fine. $2.2 billion…Imagine that. The state that has the second highest per capita income in America had so over-spent, over-borrowed, and over-taxed—that it would not meet payroll in March of 2010. So we acted immediately to use the executive authority of the governorship to impound $2.2 billion in projected spending…without raising taxes on the people of the state who had had their taxes raised and fees 115 times in the eight years preceding my governorship. 115 tax and fee increases in eight years.

New Jersey Governor Chris Christie

Recall that Bankman-Fried gave at least $40 million to Democrats in advance of the rigged and stolen 2022 midterms. Even worse, after Elon Musk took over Twitter, he indicated that the actual figure for SBF’s donations to Democrats exceeds $ 1 billion. The alleged donations of over $1 billion occurred after Bankman-Fried moved $10 billion in client assets at FTX to his trading firm and hedge fund Alameda Research.

More recently and in further entangling ways, Alameda’s ex-CEO Caroline Ellison, who is SBF’s polyamorous lover and who I accurately projected would roll over on SBF, admitted the following subsequent to the rollover: “We prepared certain quarterly balance sheets that concealed the extent of Alameda’s borrowing and the billions of dollars in loans that Alameda had made to FTX executives and to related parties.”

The pertinent question becomes this: How much of those loans were funneled back to the U.S. politburo in the form of donations?

Who was the primary beneficiary of SBF’s donations? Barack Obama’s former vice president and illegitimate U.S. President, Joe Biden.

This brings forth the central node to all of this; the cartel that lies between Sam Bankman-Fried and John Corzine: The Obama/Biden/Clinton cartel. Therein, institutional preservation bears down, and that entails fake pandemics that deliver stolen elections.

Consider this [source],

It should come as no surprise that two of Jon Corzine’s biggest supporters are Barack Obama and Vice President Joe Biden. At a Corzine campaign rally in Edison, New Jersey, in October 2009, speaking of the administration’s quandary regarding how to deal with the banking turmoil in 2008, Biden made it clear why, in retrospect, the Obama administration’s economic policies are so reckless and confused:

American Spectator

I literally picked up the phone and called Jon Corzine and said “Jon, what do you think we should do?” The reason why we called Jon is because we knew he knew about the economy, about world markets, about how we had to respond, unlike almost anyone we knew.

Joe Biden

Right, when the evidence appears as bad as it gets respective to the disastrous outcomes for this once proud Constitutional Republic that has been hijacked by the Obama/Biden/Clinton cartel, it gets worse [source]:

Biden went on to say that Corzine gave the administration the framework for a national economic recovery plan. Thus, the Obama stimulus, which wasted a trillion dollars of our children’s future earnings, was inspired and perhaps designed by an inveterate reckless gambler and financial mismanager.

American Spectator

Like it is for so many in the elite, it’s all about nepotism, and with nepotism comes the Clinton connections. Consider [source]:

THE MOST OBVIOUS TARGET for Jon “It’s who I know, not what I do” Corzine was Gary Gensler. Mr. Gensler was appointed by Barack Obama in 2009 to be chairman of the Commodity Futures Trading Commission, the agency with the responsibility to regulate commodities and futures markets, including brokerage firms like MF Global.

Corzine had been Gensler’s boss at Goldman and the two were long-time personal friends. Gensler is a major donor to Democratic Party organizations and candidates, giving more than $230,000 in the past decade to about thirty individual candidates and more than a dozen states’ Democratic Party committees.

American Spectator

We take it bit by corrupt and criminal bit to establish our nexus to Hillary Clinton that is extended from John Corzine to Sam Bankman-Fried.

First, SBF lobbied both the Commodity Futures Trading Commission and the SEC, whereby the CFTC has jurisdiction over cryptocurrency, which overlaps FTX. Moreover, it’s none other than Gary Gensler, who is now the current Chairman of the SEC under the Biden Regime.

Gensler’s connections drawback to fellow MIT colleague and professor Glenn Ellison. That last name should sound familiar because it’s Alameda’s ex-CEO Caroline Ellison’s father.

What else do we know about Genlser? This: Gensler was Hillary Clinton’s Campaign CFO and funded the notorious Trump-Russia lie.

As I continue to say, it’s “all in the family,” or perhaps it’s more apropos to state it’s “all in the cartel,” the Obama/Biden/Clinton cartel.

As delineated above, there’s no real difference between Democrats and Republicans, but Democrats are unquestionably more deeply implicated respective to both Corzine and Bankman-Fried, and relative to the former, the always duplicitous and complicit MSM carries water for the cause [source]:

Eventually, Democratic members of Congress realized that they couldn’t cover for Corzine despite his close ties to Barack Obama—who, like Biden, campaigned for Corzine in 2009 prior to Corzine’s becoming the first major victim of the public’s ongoing revolt against Democrats. When Democrats in Congress started asking hard questions, the media decided they had clearance to cover the story. So, in December, ABC, CBS, and NPR each reported on Corzine’s testimony—without mentioning the word “Democrat.”

American Spectator

So, we look to Corzine as the roadmap for the Bankman-Fried destination acknowledging that Corzine’s trial was a civil case and Bankman-Fried’s is a criminal case. That will matter not, however, because what really matters is a corrupt and criminal cartel that includes an infiltrated and owned judiciary encompassing SDNY that is functioning to protect its own. Its own included Corzine, and it includes Bankman-Fried, so long as SBF stays in line by refusing to roll over on his handlers and principals.

What avenues do we see on the Corzine roadmap?

We see that the first avenue is an interstate, and it’s the expressway to institutional preservation.

We see that just like SBF, Corzine’s MF Global Trial fell under the jurisdiction of SDNY.

We see that Corzine essentially walked away unscathed and no worse for the wear after the two sides in the trial reached a $5 million settlement.

We see that the string pullers standing to determine the fate of their functionaries – Corzine and Bankman-Fried – thread back to the same corrupt, criminal, and treasonous cartel that has rigged the entire federal apparatus and all of its departments, agencies, and institutions to steal elections and hijack the country.

We see how the string-pulling cartel has extended into the same types of intrusions in the private sector as found in MF Global, Alameda Research and FTX.

We see how the string-pulling cartel is still Obama, Biden, Clinton, and their ilk.

Today’s Sam Bankman-Fried is yesterday’s John Corzine, and neither the mechanisms nor the outcomes have changed or will change. This is because the same Obama/Biden/Clinton cartel remains positioned between the two.

As John Corzine’s history tells us, the FTX fix is in, and SBF is going to walk, relatively speaking. Write it down and go deposit it with the bank man.

-End-

This piece was written by Political Moonshine on December 24, 2022. It originally appeared in RedVoiceMedia.com and is used by permission.

Read more at RedVoiceMedia.com: Lake Lawsuit To Go To State Supreme Court After New Evidence Proves “Arizona’s Election Was Stolen” [VIDEO] New House Bill Aims to Strip Away Pharma’s Liability Protections from Injuries and Deaths Grand Jury Request Goes Through In Florida: “They Won’t Be Able to Hide Anything”

The opinions expressed by contributors and/or content partners are their own and do not necessarily reflect the views of LifeZette.

Join the Discussion

COMMENTS POLICY: We have no tolerance for messages of violence, racism, vulgarity, obscenity or other such discourteous behavior. Thank you for contributing to a respectful and useful online dialogue.